Onchain is the New Online

Monday, 2 September 2024 · 7 min read · thoughts

gm! It’s been a long while. 👋

Onchain summer is here. A new wave of consumer crypto apps is coming. 🕶️

What’s happening?

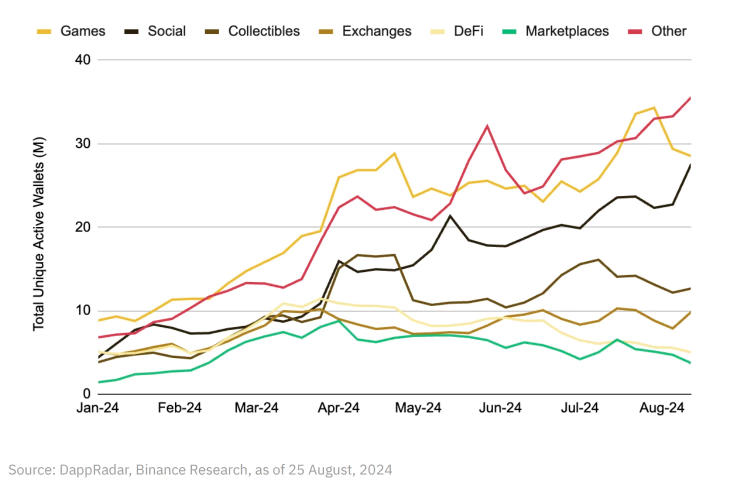

In the past year, consumer dapps have driven substantial growth in unique active wallets.

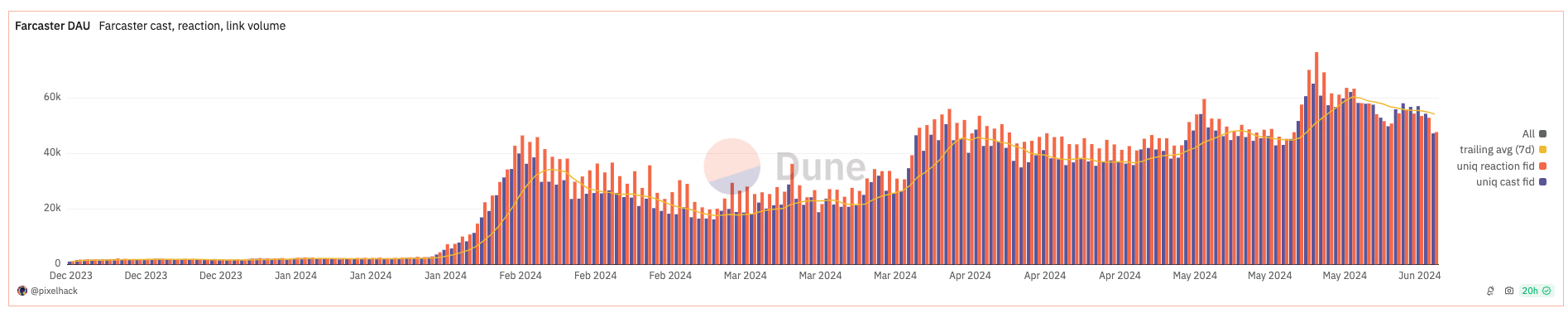

Decentralized social is booming

Web3 social apps are no longer a niche use case. Farcaster and Lens are breaking records in user activity.

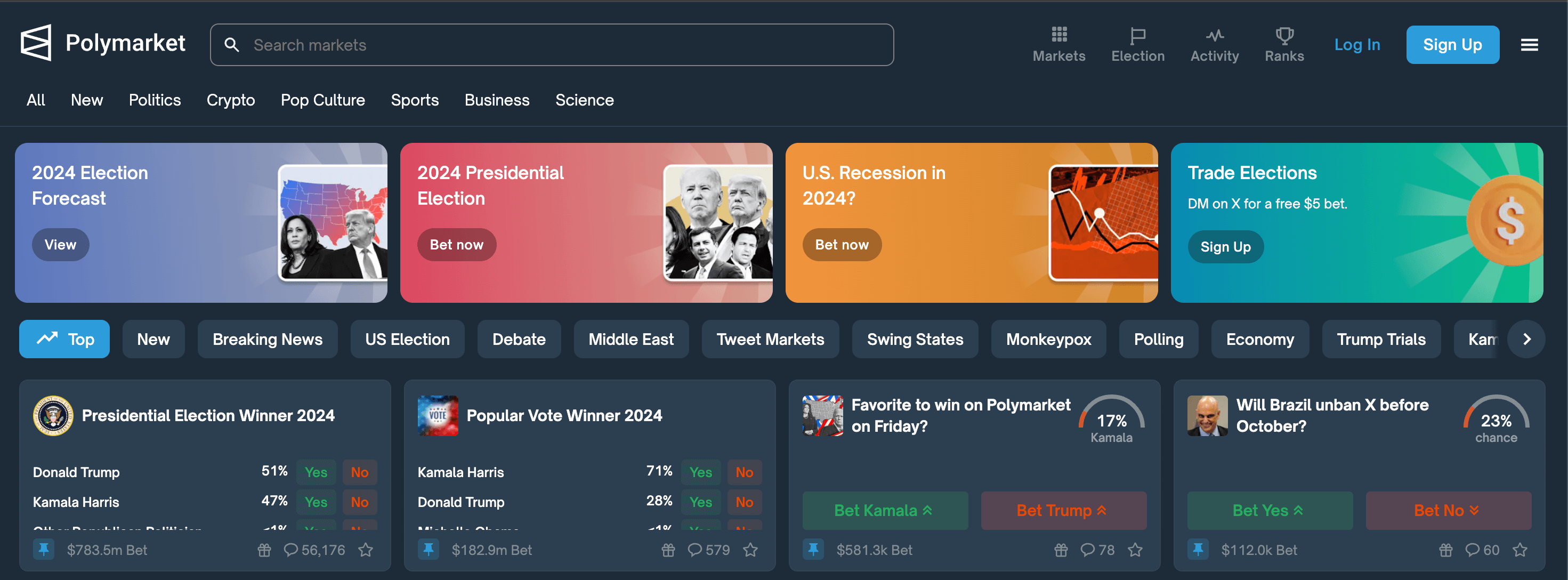

Prediction markets entered the mainstream

Last month, Polymarket, an onchain prediction market, saw a massive increase in activity with a volume of $472.87 million and over 50,000 active users.

Stablecoins are everywhere, with TradFi joining in

Stablecoins are experiencing rapid growth.. Today, 56% of Fortune 500 companies are working on on-chain projects. Stablecoins now process more than twice as much transaction value as Visa every month. Bitcoin ETFs counts $63b in assets under management. BlackRock & Fidelity have launched tokenized Treasury products with nearly $1b in assets combined. Stripe now allows its merchants to accept payments in Ethereum, Solana, & Polygon without transaction fees. PayPal’s stablecoin has more than $0.5b in assets.

This trend continues as stablecoin APIs are laying more and more crypto rails. I believe stablecoin-based products will replace traditional payment networks. It’s already faster (days vs seconds) and cheaper (10s of dollars vs cents). It will bring billions of new users onchain.

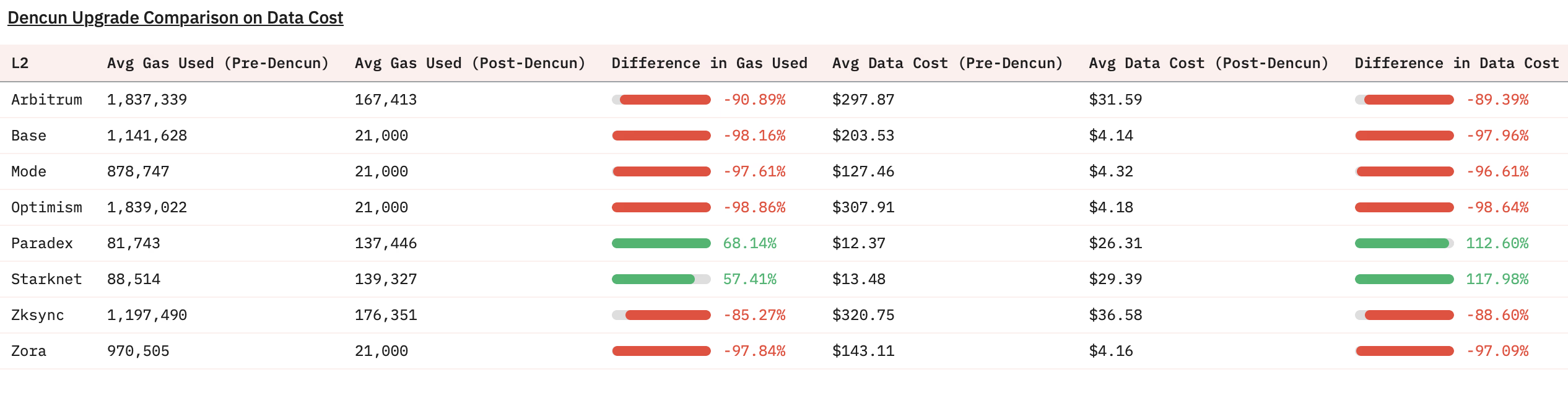

Blockchains are now scalable

On the infrastructure side, network fees are at an all-time low thanks to the Dencun upgrade and new L2s. Today, builders can deploy new consumer-friendly rollups in a few clicks with Conduit and Caldera.

Usability in web3 is getting better

Embedded wallets and social logins are ubiquitous, enabling seamless UX for new users. Builders can onboard users with Privy and Dynamic.

These are all promising adoption signals. We are at the cusp of a new crypto consumer wave in web3, but…

What’s next?

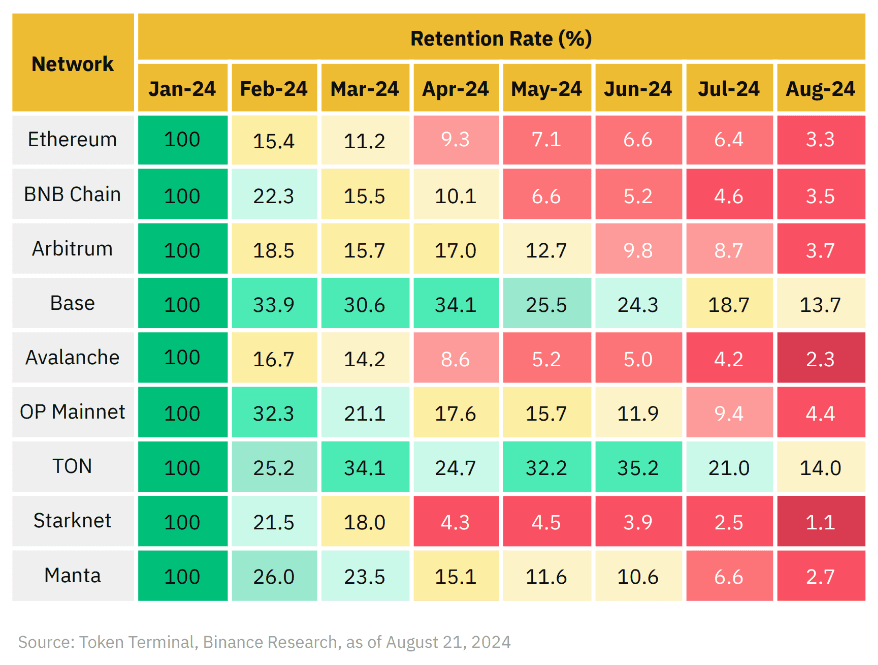

Building a successful consumer product is hard. According to Binance Research, web3 has yet to break into the mainstream:

-

Average retention rate in web3 stands at 5.4%. Web2 retention rates are significantly higher, with a good rate considered between 25-40%.

-

A prime example of crypto’s retention struggles is seen in Starknet, where user retention fell sharply from 18.0% post-March to just 4.3%. This decline was likely driven by the conclusion of their airdrop campaign, illustrating the limited impact of speculative incentives on long-term engagement.

The data indicates that beyond broadening crypto’s reach to mainstream audiences, we must expand crypto’s adoption frontier beyond mere speculation and profit-making purposes. This means creating compelling consumer crypto products that generate intrinsic demand and keep users engaged.

We need better tools

In the 2010s Hubspot and Mixpanel transformed online marketing and product analytics respectively. Analytics tools like theirs made it easier for internet builders to understand and use data about online users. Alongside them came a wave of web2 consumer apps we still use today.

Building a successful consumer product is hard. It gets harder when you don’t know who your users are and how they use your product. Analytics and data tools are fundamental for the success of consumer apps. Soon they will play a critical role in consumer crypto.

For the next while, I’ve decided to focus on solving challenges at the intersection of blockchain, data, and product analytics.

Are you building in web3? Say hi.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.