The Origin of Money

Friday, 21 February 2020 · 39 min read · economics

This is an abridged explanation of how money emerged from an initial state of barter. Most of the material is from the book Choice: Cooperation, Enterprise, and Human Action by Robert Murphy.

Murphy’s book reviews the works of Ludwig von Mises’ Human Action and Carl Menger’s On the Origins of Money. I highly recommend checking them out if you find the following summary interesting.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.

Money: How Did We Get Here?

Money is an indispensable part of everyday life.

But, the use of money is an extremely odd practice. Paper money is an item that serves no other purpose. And yet, people are willing to give up valuable goods or work long hours in exchange for these oddities. The reason they do this, of course, is because they expect other people to do the same by giving up their valuable goods and time to obtain these same items in the future.

So where did money come from? At some point in the distant past, people must not have used money. If nobody else used dollars, it would make no sense for you to sell your used guitar for a green piece of paper. How did humanity get to this point, where just about every human on planet Earth accepts money?

A World without Money

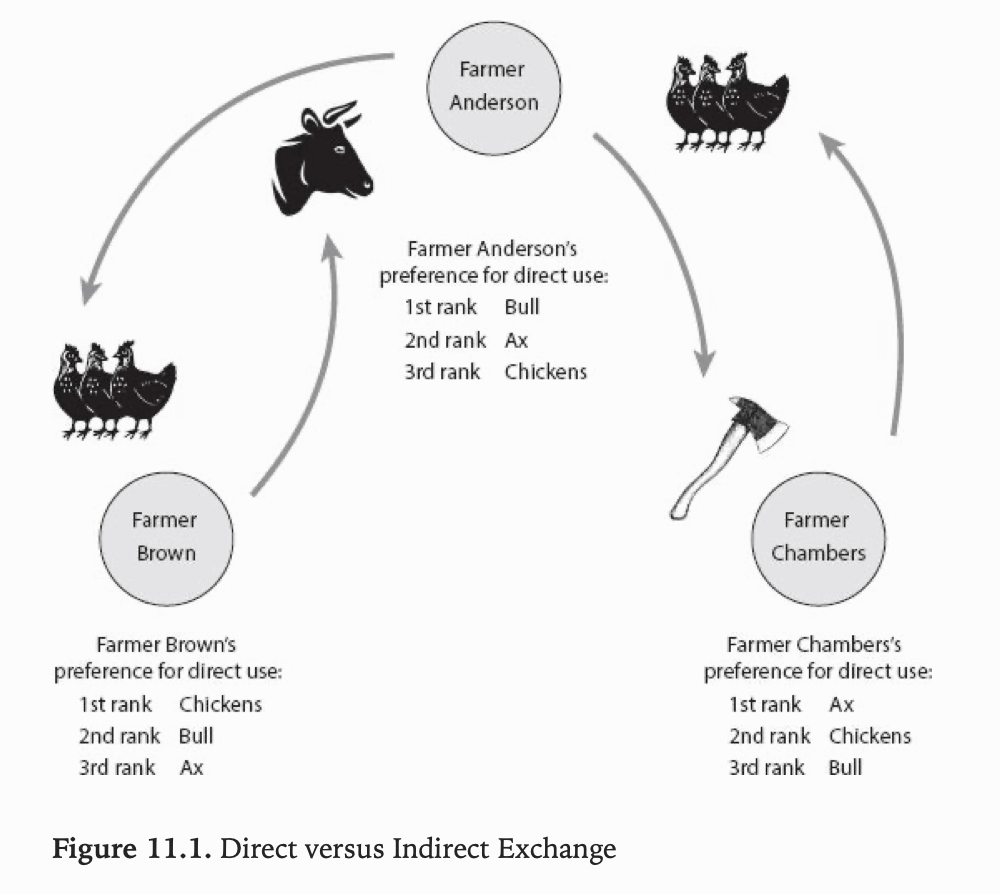

Let’s start by looking at how barter works. Consider an example of three farmers, each owning axes, chickens, and bulls respectively.

Farmer Anderson approaches Farmer Chambers, offering his ax for their chickens. Chambers agrees, as he prefers the ax to his chickens. However, Anderson does not actually want the chickens; he wants a bull from Farmer Brown. Nonetheless, the reason he agreed to the exchange is because he believes that Farmer Brown would prefer the chickens over the bull.

Anderson engaged in indirect exchange when he traded away his ax for Chambers’s chickens, planning to use them to acquire a bull in further exchange. In this example, the chickens served as a medium of exchange.

The Liquidity Factor for Goods

Carl Menger saw that even in a world without money, different goods would have different degrees of saleability or marketability or liquidity.

Goods such as eggs and tobacco would have a wide market, meaning that many people in the community regularly want to acquire them in trade. On the other hand, goods such as horses and spears would have a narrow market, meaning that only a few people would be seeking to acquire them on a given trading day.

With a liquid good, you can find a buyer willing to pay the highest likely price in a very short time. In contrast, selling an illiquid good is typically a very time-consuming process.

Thus, Menger argued that someone going to market with relatively illiquid goods would — as an intermediate stepping stone to his ultimate objective — trade them away for goods that were more liquid, even if the person didn’t really desire those particular goods. Liquid goods were better media of exchange.

Other Physical Factors at Play

Suppose Farmer Anderson (who sells axes) encounters a buyer who offers a large quantity of eggs, and another buyer who offers a large quantity of tobacco. Both the eggs and tobacco are far more liquid and marketable than his axes, but Anderson will clearly prefer to trade for the tobacco.

This is because a large quantity of tobacco is much more convenient to carry around than a large quantity of eggs. After all, the eggs can easily break, and even if Anderson handles them gently, they will soon spoil. In contrast, tobacco is much sturdier and will last for much longer.

Thus, we can conclude that people are more willing to adopt a good as a medium of exchange depending on its physical durability and longevity. Some other desirable properties would be its divisibility — tobacco can be divided into smaller quantities for smaller purchases much more easily than axes can be divided — its homogeneity, and its efficient market exchange value relative to its physical weight.

Certain Goods Enter a Positive Feedback Loop

Money has network effects.

Goods that were initially relatively liquid because of their physical characteristics would see their liquidity enhanced as a new batch of people sought to acquire them for trading purposes.

The tobacco farmer heading to market is already in a strong bargaining position because plenty of smokers are probably at that very moment heading to buy tobacco. However, once people grasp the advantages of indirect exchange, the demand for tobacco will increase further. Even nonsmokers heading to market may be willing to trade their goods for tobacco, so long as the goods they start with are less liquid than tobacco.

Thus, the number of traders willing to accept tobacco increases, precisely because tobacco has so many people willing to accept it. Goods enjoying an initial superiority in liquidity will see that superiority enhanced.

Historical Moneys

People across time and cultures often turned to the precious metals as media of exchange, because they score well on all criteria.

Gold and silver are easily divisible and can be recombined again. Unlike eggs, gold and silver are not fragile and will never spoil. Gold and silver are also preferable to tobacco because they have a more convenient market exchange value relative to their weight. Farmer Anderson would find it easier to trade his axe for a few ounces of gold or pounds of silver rather than for hundreds or even thousands of pounds of tobacco.

Gold and silver are also better media of exchange than precious stones such as diamonds and rubies because the latter come in different sizes and qualities and must be evaluated on a stone-by-stone basis; a large diamond is more valuable than two smaller diamonds that have the same combined weight, whereas a hunk of gold weighing an ounce is roughly the same market value as two smaller hunks weighing a half-ounce each.

As certain goods became acceptable in trade to an ever-widening group of people, those goods became that much better as media of exchange. Eventually, only a handful of commodities rose to the top and were embraced by just about everyone. These media of exchange were now money because by definition, money is a medium of exchange that is almost universally accepted within a community.

Commodity money are more valuable compared to when it was just a commodity. As more and more people accept the good as money, its monetary value as a medium of exchange is added on top of its nonmonetary value onto its final price.

How We Got to Commodity Money

Thus, we arrive at a situation where everyone used one good as the universally accepted medium of exchange. We’ve explained how everyday commodities—which were initially valued solely for their direct usefulness, either in consumption or production—could begin to do double duty as media of exchange and how some of these media of exchange eventually rose to the status of money.

Money is another example of a spontaneous order in nature, in which individuals acting in their narrow self-interest bring about a complex and socially beneficial result that no single person could have imagined beforehand.

But, how did humans end up accepting paper money?

Escaping the Circular Logic of Paper Money

If the money in question happens also to be a regular commodity — such as tobacco or gold — then its demand is the sum of two partial demands:

- the demand from its use in consumption and production and,

- the demand from its use as a medium of exchange.

Even without trade, a commodity’s price can be pegged to its direct usefulness in consumption and production.

On the other hand, when money is useful only as a medium of exchange — such as dollars, euros, yen, and pounds in today’s world — then people hold it solely because of its use as a medium of exchange. It has no value beyond its monetary usefulness.

If everyone suddenly forgot the ballpark price of a Ferrari and had no idea if it would trade for a pack of gum or a house, it would not take very long for Ferraris to regain their relative exchange value against everything else.

Blind people and others without drivers’ licenses would not initially be interested in acquiring Ferraris, even if offered for a pack of gum, because they would have no use for them. But those driving vehicles would be able to inspect a Ferrari and know immediately that it was a desirable item. Soon enough, Ferraris would once again command a high price in the market relative to other goods.

If people somehow suddenly forgot what $100 could buy in the marketplace, then the dollar would cease to be money!

People couldn’t inspect a dollar bill and realize its usefulness, restoring the demand for dollars back to its previous height in a matter of days. The problems of direct exchange would once again manifest themselves, and individuals would experiment with various media of exchange until a new money emerged—which in all likelihood wouldn’t be dollars in this new timeline.

We seem to be saying: “People value units of paper money because people value units of paper money.” Paper money serve no useful purpose except in their roles as media of exchange. So how did we decide how much paper money is worth?

Mises’ Regression Theorem

Neither a buyer nor a seller could judge the value of a monetary unit if he had no information about its exchange value—its purchasing power—in the immediate past.

– Ludwig von Mises

Mises introduced the time element to escape the apparent circularity of this position.

We explain the purchasing power of money today—meaning how many units of milk, eggs, horses, and so on a unit of money will fetch on the market today — by what we expect the purchasing power of money will be tomorrow. For example, to understand why someone today would trade eight hours of her labor for $160, we use her expectation that tomorrow she will be able to trade that $160 for a new purse. Then, to explain how people could expect the purchasing power of money tomorrow, we use the fact that they observed money’s purchasing power yesterday.

Mises avoids infinite regress by showing that at some point in our explanation, the purchasing power of a medium of exchange on Tuesday is explained by the exchange value of that same good on Monday, even though on Monday the community was in a state of purely direct exchange. Mises called his solution the regression theorem.

For example, if we are talking about gold then we can trace its purchasing power back to the point at which people valued gold because of its beauty or because of its use as a metal. On our Monday — the last day of purely direct exchange — gold would have had a market value, and people would have seen that it was very liquid, as well as divisible, durable, and all of the other properties making it an excellent medium of exchange. Then on our Tuesday — the day that indirect exchange was born — one person accepted gold in exchange for what he was offering in trade, not because he wanted the gold for his own use, but because he knew it would be easier to find a trading partner who wanted gold.

When making this decision, the person knew what a certain weight of gold would fetch in the market because he had just observed various transactions involving gold the day before, on Monday. But by his very willingness to accept gold on Tuesday, the man adds to gold’s purchasing power; gold is now more valuable on Tuesday than it had been on Monday, in the days of direct exchange. The snowball process thus begins, with more people accepting gold on Wednesday because it is now an even better medium of exchange, in light of what they saw on Tuesday. And so on, until gold was the undisputed money of planet Earth.

In summary: Today’s purchasing power is derived from individuals’ expectations about tomorrow’s purchasing power, expectations that are themselves based on yesterday’s purchasing power. By introducing the time element, we can break out of the vicious circle; we are not explaining the purchasing power of money by the purchasing power of money because the purchasing power at one time is explained by the purchasing power of an earlier time.

Next, let’s look at the gold standard to see how we arrive at the purchasing power of pure paper money.

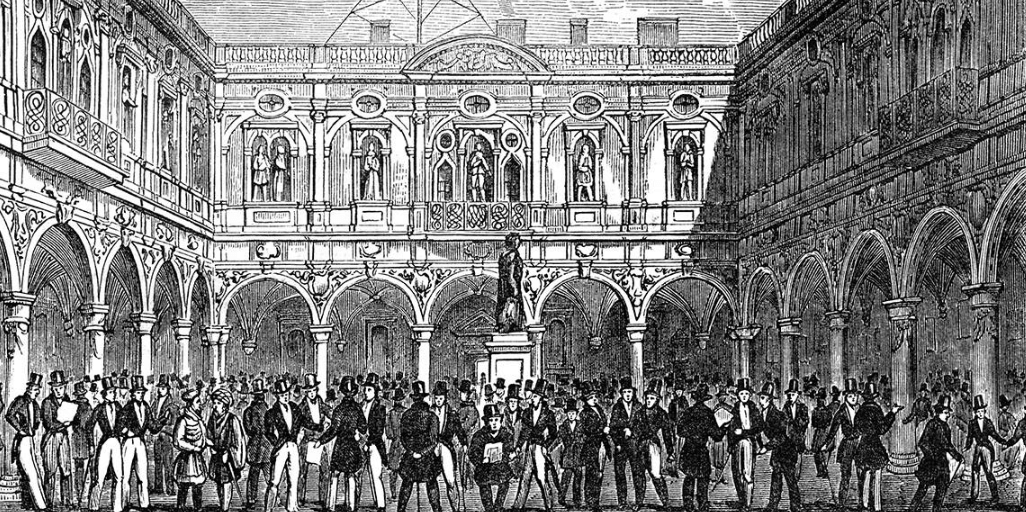

The Gold Standard

Early on, the government’s role in regulating money was limited to establishing uniform weights and measures; a dollar was 23.22 grains of gold the same way that one foot is 12 inches. The point wasn’t to steer the macroeconomy or create the optimum rate of inflation. Rather, the government’s purpose was to provide a uniform standard for citizens to use in their transactions.

During this time, government paper money was a redemption claim on commodity money that arose on the market. For example, in the spring of 1933, anyone, not just other governments, could turn in dollars to the U.S. government and receive gold at the rate of $20.67 per ounce. In 1900, the U.S. government defined one U.S. dollar as 23.22 grains (1.505 grams) of gold. Going back even further in U.S. history, there were periods where the government pledged to redeem dollars in specific weights of either gold or silver.

The dollars served as money substitutes because people could hold dollars rather than physical gold. So long as everyone in the community had no doubt that an amount of the currency could be exchanged for an ounce of yellow metal, these pieces of paper performed all of the monetary functions of gold without the hassle of carrying them around.

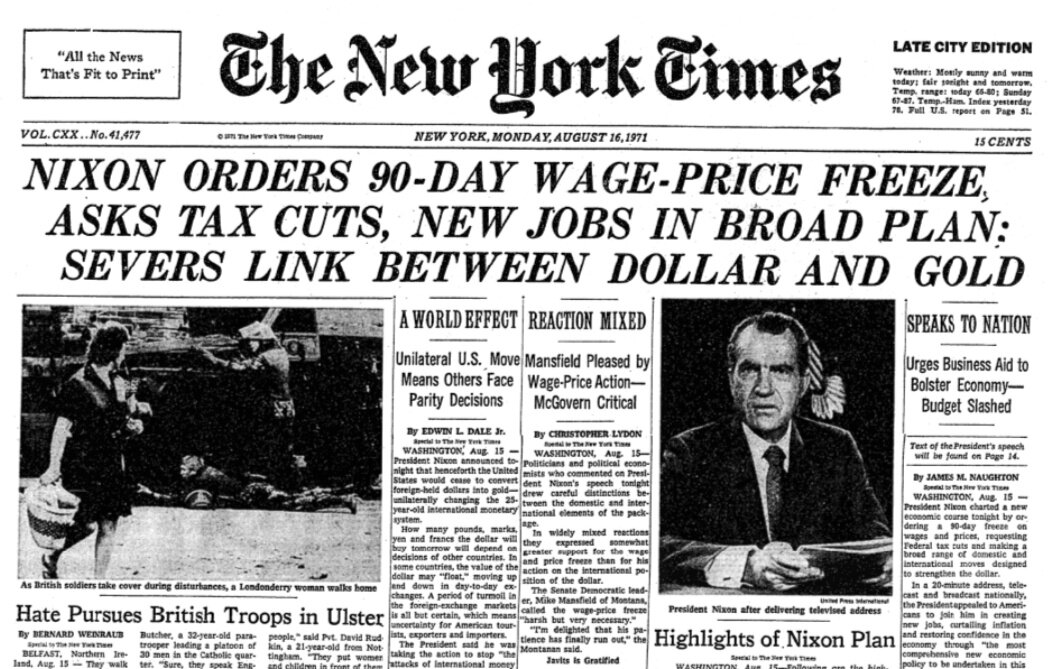

On August 15, 1971, U.S. President Richard Nixon closed the gold window and formally ended the Bretton Woods agreement formed at the close of World War II. Even here when the gold standard was permanently suspended, dollars still satisfy the definition of money because the public commonly accepts thems in trade, with the intention of using them in the future to acquire other goods and services.

Remember that the demand for a medium of exchange is the components of two partial demands: the demand from is use in consumption and production and the demand from its use as a medium of exchange. Over time, as we moved away from the gold standard, paper money gradually lost the nonmonetary component of its price, and only kept its value as a pure medium of exchange.

If knowledge about money’s purchasing power were to fade away, the process of developing indirect exchange and media of exchange would have to start anew. It would become necessary to begin again with employing some goods, more marketable than the rest, as media of exchange…”

– Ludwig von Mises

People today sell goods and services for dollars because of expectations derived from their observations of the dollar’s purchasing power yesterday. This purchasing power originally came from their redeemability for a genuine commodity money such as gold. A similar story could be given for all of the other fiat currencies in today’s world. Even though they never served themselves as useful commodities in a nonmonetary world, their purchasing power can be traced, step by step, back until they were legally redeemable for a genuine commodity money such as gold.

Summary

Money is a medium of exchange. People hold money in their cash balances because they expect to be able to use it to buy other goods and services in the future, which will be directly useful.

Some liquid goods became even more liquid through a positive feedback loop. A handful of commodities rose to the top and were embraced by just about everyone. These media of exchange were now money: commodity money.

People today sell goods and services for paper money because of expectations derived from their observations of the dollar’s purchasing power yesterday. Their purchasing power can be traced, step by step, back until they were legally redeemable for a genuine commodity money such as gold.

Over time, as we moved away from the gold standard, paper money gradually lost the nonmonetary component of its price, and only kept its value as a pure medium of exchange.

Further Reading

If you’re like to learn more, please check out the book Choice: Cooperation, Enterprise, and Human Action by Robert Murphy. The book relays the main insights from Ludwig von Mises’ Human Action and Carl Menger’s On the Origins of Money in a very approachable way.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.