Patronage Markets

Saturday, 4 May 2019 · 73 min read · cryptoeconomics patronage

To learn more about the why, check out The Fall of Fan Patronage.

A Patronage Market is a cryptoeconomic system that facilitates the creation of market-driven communities between Creators and Patrons on the Ethereum blockchain, without the need to trust counterparties or to pass intermediaries. It’s an alternative crowdfunding mechanism for a creative space plagued by platform censorship.

In a Patronage Market:

- Creators issue unique personal cryptocurrencies backed by products and/or services which makes it spendable.

- Patrons collect tokens to redeem it for services and/or exclusive privileges, acquire social status, and invest in promising Creators.

The market uses a ‘complementary currency’ called Patronage Tokens as the currency of exchange, creating tokenized economies and communities.

Let’s learn about the Patronage Markets concept and how it works.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.

Brief History of Private Currencies

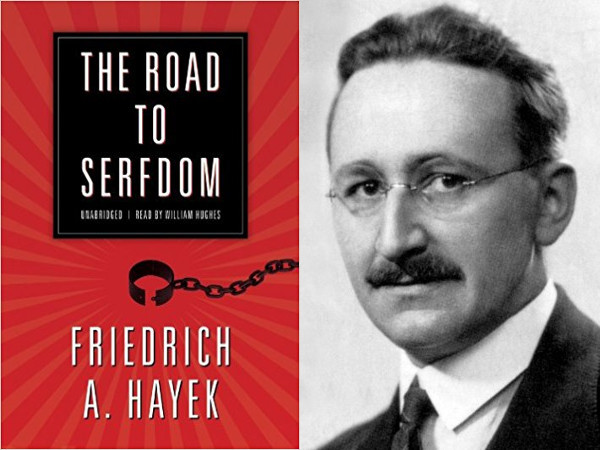

There is no answer in the available literature to the question why a government monopoly of the provision of money is universally regarded as indispensable.

– Friedrich Hayek, “Denationalization of Money”

Economist Friedrich Hayek advocated the establishment of a system of private currencies that compete for acceptance. These complementary currencies are not a national currency, but would supplement or complement national currencies. Today, there are over four thousand privately issued currencies in more than 35 countries.

Local Currencies

Complementary currencies includes community currencies such as the BerkShares, Bristol Pound, and Ithaca Hours which were created to strengthen the local economy. These currencies are accepted by cooperating businesses in a local community. They help assure that a high percentage of spending will remain circulating within the community.

Virtual Currencies

Electronic forms of complementary currencies exist too, except they operate on a global basis. For example, Tencent’s QQ coins are a virtual currency that are used to buy QQ-related virtual products and services. Though these electronic currencies are not ‘local’ in the traditional sense, they cater to the needs of a specific digital community.

Personal Currencies

Complementary currencies can be issued and backed by an individual instead of a group. For example, KMikeyM is a digital currency that gives holders input on the personal choices of Mike Merril. BitchCoin is a digital currency backed by the photography of Sarah Meyohas at a fixed exchange rate of 1 BitchCoin to 25 square inches of photographic print. By purchasing these personal currencies, patrons are buying credit for a Creator’s future work.

Patronage Tokens

There is no economic reason not to allow every private citizen to enter the minting business and to offer his own coins. It is true that a private minter too might abuse the trust his customers put in him and his coins.

But punishment is immediate: he will lose all his customers. People will start using other coins issued by people they have reason to trust more.

– Jörg Guido Hülsmann, “The Ethics of Money Production”

When you adjust the parameters, you conceive Patronage Tokens: complementary crypto-currencies spendable within a specific online community. Anyone - including individuals - can issue their own personal cryptocurrency and back it with services which make it spendable. People can choose to accept it as payment, or not.

The decentralized architecture of the blockchains guarantees that the ownership information of tokens remains verifiable, immutable, and secure. You no longer need a centralized, trusted issuer to oversee the production of currency and enact monetary policy.

In a Patronage Market, Patrons can redeem Patronage Tokens for goods or services. For example, this may be a Creator’s professional services such as an art commission or a short video call, which are priced in Patronage Tokens.

A Creator may also host applications that perform a unique function in exchange for tokens, like rides in a fair. These decentralized applications (dApps) can support a variety of use cases such as minting digital collectibles, rare sponsorship auctions, and community votes. Different dApp operators can have their own rides and set their own price in terms of tokens. Anyone can create a Patronage Market for anything and build on top of it without having to ask permission.

Patronage Token Model

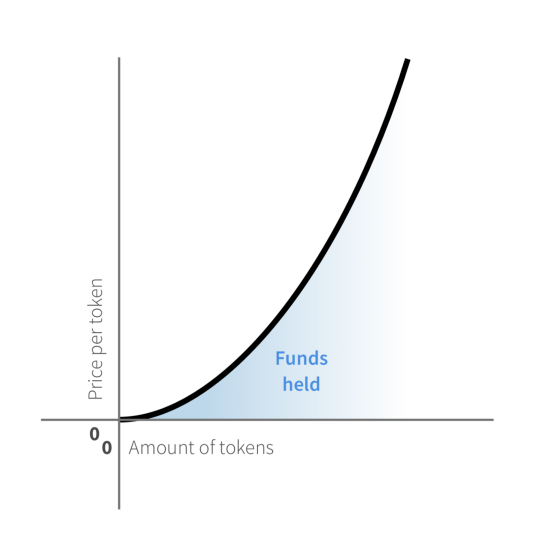

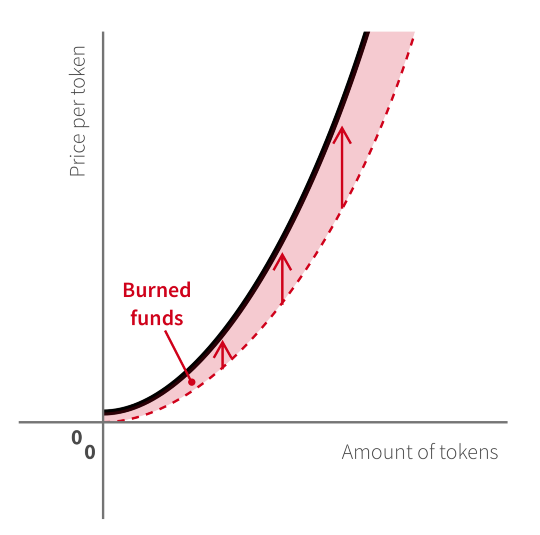

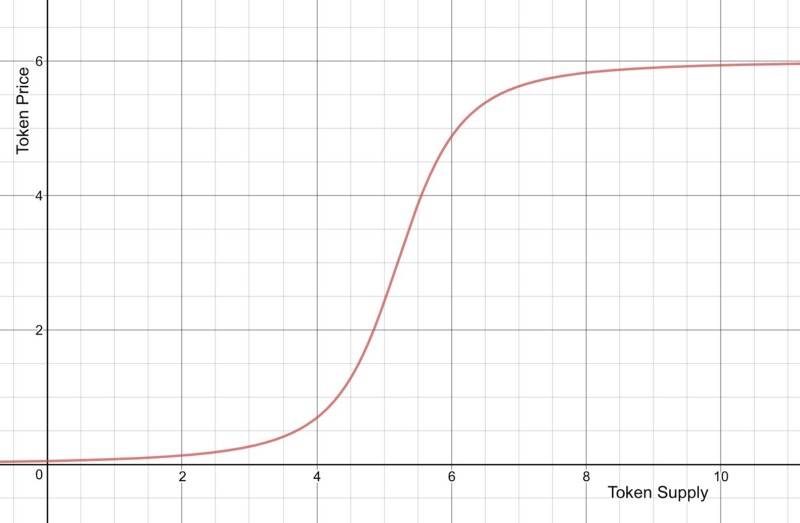

Patronage Tokens utilizes the Continuous Token model, in which tokens are created when bought and destroyed when sold. The spot price of a Patronage Token is calculated based on its current supply, which fluctuates as tokens are continuously created and destroyed according to the demands of the market. There is no ICO nor crowdsale in which the entirety of a Patronage Token’s supply is generated all at once.

Continuous Tokens have the following properties:

- Limitless supply. There is no limit to the number of tokens that can be minted.

- Dynamic supply. The token supply increases and decreases according to market forces and network activity.

- Deterministic price. The buy and sell prices of tokens increase and decrease with the number of tokens in circulation.

- Continuous price. The price of token n is less than token n+1 and more than token n-1.

- Instant liquidity. Tokens can be bought or sold instantaneously for its Reserve Token amount at any time, at deterministically calculated prices.

A Patronage Token’s spot price is deterministically calculated by a smart contract based on the current supply of the Patronage Token, the current balance of a Reserve Token pool, and a constant Reserve Ratio.

Put simply, as the total supply of the Patronage Token increases so does its price, and vice versa. When Patrons purchase Patronage Tokens by sending an amount of Reserve Tokens to a smart contract, they receive a proportionate amount of Patronage Tokens in return. As a Patronage Token’s reserve pool increases, the refund paid out when you sell the Patronage Tokens back will increase, incentivizing early discovery and participation.

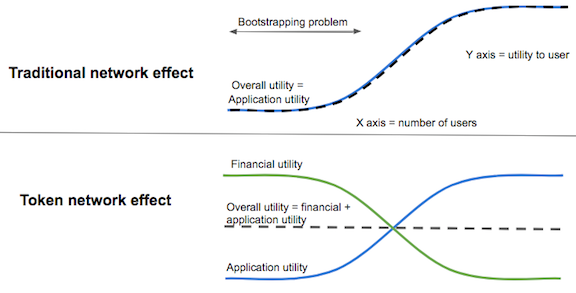

Lower prices for early adopters also helps overcome the bootstrap problem by adding financial utility to a token when the mechanical utility is low.

The Patronage Token model adds a handful of mechanisms and levers to the basic Continuous Token model, which we’ll learn next.

Enabling Upfront Funding through Contribution Fees

Some projects need to front-load revenue in order to pay for initial development costs. However, bonding curves are not designed to fund projects; the reserve pool is effectively locked in until tokens are burned. Creators may need to wait a long time before they can obtain funds from arbitrage.

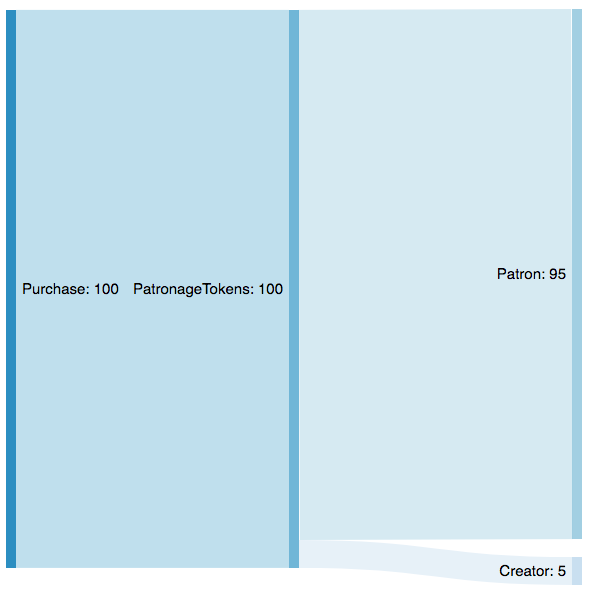

Patronage Tokens extends the bonding curve model by introducing a contribution rate. Creators can set a tax on buyers and capture a percentage of value upfront as immediately liquid funds. These funds can then be used to pay for operational costs or held as stake.

When a Patron buys a Patronage Token, the amount of tokens bought or sold can be split in a predefined ratio between the Creator and the Patron. For example, a Creator sets a 5% contribution rate. This means 95% of newly minted tokens goes to the Patron who bought it, while the remaining 5% is set aside for the Creator. Contribution fees accumulate over time within the Patronage Token smart contract and can only be withdrawn by Creators. Creators can choose to sell their tokens now to realize an immediate return or HODL to realize a greater potential return in the future.

Contribution rates introduces a significant economic incentive for its creators to make the Patronage Market successful in the long run. In addition, having non-zero taxation on buying tokens helps discourage pump-and-dump behaviours. Speculators now require a larger spread over a longer time window before he can profit from arbitrage.

Continuous Accountability

Competition in coinage is no panacea. Abuses are always possible and in many cases they cannot easily be repaired. The virtue of competition is that it offers the prospect of minimizing the scope of possible abuses. And its great charm is that it involves the entire community of money users, not just some appointed or self-appointed office holders.

– Jörg Guido Hülsmann, “The Ethics of Money Production”

Token pre-sales or Initial Coin Offerings (ICOs) burden participants with excessive upfront risk due to a lack of accountability and poor liquidity. In an ICO, tokens are minted all at once in an initial Token Generation Event at the project’s inception. There is a high risk of abandonment by the project’s owners, in which buyers are left with worthless tokens.

In contrast, a Patronage Token carries less upfront risk due to its continuous nature. Under a Continuous Token model, tokens are created and destroyed throughout the lifetime of a project. In addition, tokens can have full liquidity or close to it when contribution fees are low. This allows markets to earn more when it succeeds and to naturally dissolve when it is no longer needed.

When a Patronage Market goes awry, market participants are given voice through community governance, both on-chain (via the protocol) and off-chain (via the social structures around the protocol.) In the worst case, participants can exit by leaving the market, liquidating their tokens, and recover some of their bonded assets.

Network Value Capture through Sponsored Burning

There has been many discussions around the token velocity problem. We want to design a token model which closely links usage of the Patronage Market to the value of the Patronage Token, and which community members do want to hold. For a token to accrue stable value, it’s good to have token sinks (burn rate) - places where tokens actually disappear and decreases the token’s total supply as network usage grows.

To dampend the velocity problem, a percentage of Patronage Tokens spent can optionally be sponsor-burned and removed from circulation. This can be thought of as a profit-share (or buy-and-burn.) For example, a marketplace dApp may sponsor-burn a 1% fee from a successful bounty’s price before sending the remaining amount to the worker. A smart contract can:

- First, collect the marketplace gas in Ether and buys an amount of Patronage Tokens with Ether from the automated market maker.

- Second, burn the acquired Patronage Tokens. Sponsored burning effectively removes tokens from circulation without claiming its bonded reserve asset, thus increasing the collateral value of the remaining tokens.

Sponsored burning would make the token backed by the future expected value of upcoming fees spent within the network, linked purely to usage. As demand for the underlying service grows, demand for the token increases in direct proportion, and token holders with exposure to the value of the network benefits. Sponsored burning creates a transparent way to figure out the value of the patronage token. The token’s value is no longer entirely beholden to market speculation.

Under the Patronage Token model, tokens are minted and/or burned according to the following activities:

- Minted when contributions are made to the reserve pool;

- Burned when market activity (such as fulfilling a bounty) is completed;

- Burned when Patronage Tokens are redeemed for its reserve collateral;

Sponsored burning and minting can also be used to incentivize socially-beneficial behaviours. Tokens can be burned as punishment for fradulent actions and minted as rewards for desirable actions in the market. For example, a dispute resolution service could sponsor-mint stakes to cases that are valid, and sponsor-burn stakes to cases that are invalid.

Tokenized Communities

Tokenization is a process of converting all sorts of rights into custom-built tokens that may be associated with any type of particular privileges, such as special access, dividends, or voting rights. Tokens are trustless and do not require intermediaries for their processing. This fosters new forms of unmediated interactions within the space in a safe and tamper-proof environment. Tokens give the ability to make individual rights fungible, shareable, and transferrable while at the same time being highly versatile and customisable.

Creators are free to decide upon their Patronage Token’s functionality, characteristics, and branding. These functions can be tailored to the specific purpose they shall serve. They can be used as a means to crowd-fund creative work, as a medium of exchange, or store of value. Around the ownership of their tokens, vibrant communities and peer-to-peer economies can form where value can freely flow between market participants and convey signals in real time.

Open and Permissionless Innovation

Our freedom of choice in a competitive society rests on the fact that, if one person refuses to satisfy our wishes, we can turn to another. But if we face a monopolist we are at his absolute mercy.

– Friedrick Hayek, “On the Road to Serfdom”}

Decentralization creates an environment with permissionless innovation that is pro-startup and anti-monopoly. Startups today need to navigate a complex landscape of walled garden ecosystems and platforms with huge proprietary data advantages.

The decentralized nature of Patronage Markets allows any contributor to contribute to the project’s success in an open ecosystem. People and companies can innovate on top of protocols without worrying about the rules of the game changing later on. Different services can be composed together to harness their particular strengths.

With cryptonetworks, new product ideas and technologies can be developed, tested and iterated without being blocked by dominant platforms. This leads to healthy competition through creating better products rather than leveraging your current incumbency to extract profits from users.

Patronage Market participants can contribute to the community in a permissionless fashion. Creators, Patrons, and Developers are aligned through tokenized incentives to work together in the open to develop, operate, and consume services in a decentralized way. Their goal: the growth of the market and the appreciation of the token.

Emergent Trust Signalling

The price system is just one of those formations which man has learned to use […] Through it not only a division of labor but also a coordinated utilization of resources based on an equally divided knowledge has become possible.

– Friedrich Hayek, “The Use of Knowledge in Society”

Patronage Tokens compete against each other for acceptance in a kind of Darwinian battle royale. Projects that are poorly governed naturally dissolves as patrons exit the market. Prices will decrease for untrustworthy projects as supply decreases, over the long term.

Prices also serve to ration scarce resources when market demand outstrips supply; it demonstrates where resources are required and where they are not. When the price of a token rises, the demand for that token’s service decreases because it’s more expensive. Furthermore, the supply of substitute services’ increases as competitors introduce their own markets to tap onto the growing demand.

Market forces eventually arrives at the spot price of the Patronage Token based on its present utility and future expected value. The historical price and transaction data of a Patronage Token allows us to construct a higher-order social trust signal representing community consensus. This quantifiable ‘trust score’ can be used to communicate and predict a project’s trustworthiness and quality of governance.

Financial Inclusion

Users today have very little say in the ownership, behaviour and governance of their favourite organisations because they are either not paying for the services they enjoy or are not financially invested in the organisation. Without any real power, users are subjected to decisions designed to increase profit for shareholders.

Ownership and community are fundamentally linked. As humans, we tend to feel a deeper link to people we share ownership with. We are skeptical of exclusive communities where the incentives of insiders are not purely aligned with outsiders. However, financial services today are often exclusionary based on arbitrary criteria such as legal jurisdiction and investor accreditation.

In contrast, the permisionless nature of Patronage Markets allows anyone to share in the upside of a project’s success in an open marketplace. Instead of a closed group of private investors, Patronage Markets are available to the masses.

Patronage Market User Journey

To make the idea more concrete, let’s step through the typical lifecycle of a Patronage Market.

Market Creation

Alice is an illustrator by profession. She decides to open an art commission service where buyers can request line art illustrations of a subject of their choosing.

Alice creates a new Patronage Token called the Alice Token (ALT) and accepts commissions for a payment of 10 ALT each. She issues an initial stake of ALT tokens for herself by locking an amount of Reserve Tokens (such as ETH) into her Patronage Token’s smart contract. This initial reserve pool defines the ‘bottom’ price of the ALT token and influences the rate of price growth as supply increases. Having a larger initial reserve decreases the price sensitivity of the token. The reserve pool decreases only when ALT tokens are destroyed and sold back to the smart contract.

Alice’s Patronage Market has a reserve ratio of 0.9, an initial stake of 1000 ALT, and initial reserve pool of 9 ETH. Given these parameters, Patrons can buy or sell ALT tokens at an initial price of 0.01 ETH each. Patrons can purchase ALT tokens by sending ETH to a smart contract and receive ALT in return. The amount of tokens you receive is calculated deterministically based on the ALT token’s current supply.

Trading

Bob hears about Alice’s services and purchases 30 ALT tokens. After Bob’s ALT purchase, the price of ALT increases in proportion to the increase in supply. If someone believes that Alice’s service will become more valuable in the future, they can invest in her Patronage Token now and redeem or sell it later at a potentially higher valuation.

Alice sets a 10% contribution fee for ALT, so that 10% of any ALT purchased goes to her and the remaining 90% goes to the Patron. When Bob buys 30 ALT, 3 ALT will be reserved for Alice and the remaining 27 ALT goes to Bob. Alice uses her 3 ALT to help pay for her day-to-day operational expenses.

Bob requests an art commission service from Alice and sends 10 ALT to an escrow smart contract. Alice has to honour her commitment of providing a service in exchange for the ALT tokens. If she follows up on her commitment, her token will naturally grow in popularity as customer confidence grows. If she fails to follow up on her commitments, ALT token holders will lose confidence and exit the market, causing sell-offs that lead to a sharp drop in the value of Alice’s ALT tokens. The free market will eventually find a price for Alice’s service, based on both its present and future expected value.

Some time has passed and Alice’s Patronage Token has grown in volume and price. The price of ALT has increased tenfold from 0.01 ETH to 0.1 ETH each. As one of its early adopters, Bob decides to sell his ALT tokens. Alice also sells part of her initial stake of ALT. Both Alice and Bob receives a larger amount of Reserve Tokens than what they put in, earning a tidy profit on the sale. Selling Patronage Tokens decreases both the supply of ALT in circulation and the token’s spot price. The lower price of ALT may now attract new buyers interested in acquiring the token at the current rate.

Market Maturity

In addition to professional services, Alice decides to host decentralized applications that makes her Patronage Token spendable. With some help, she deploys a dApp that grant ALT token holders voting rights on community polls and another dApp that allows her to sell cryptocollectibles. Other people follows suit, deploying their own unique dApps.

Anybody can build on Alice’s Patronage Market by building a dApp that accepts ALT. Having a wide array of services increases a Patronage Token’s utility, making it more appealing to Patrons and consequently increases the size of the Patronage Market.

As the market becomes more decentralized over time, Patrons may no longer expect that Alice’s services will be a key factor for determining the value of the ALT token. Even if Alice stops offering her services, some merchants may continue to accept ALT as payment.

Currency only loses all its value when people no longer want it in exchange for what you want. What matters is that people agree to accept it in exchange for goods and services.

Market Participants

Show me the incentives and I’ll show you the outcomes.

– Carl Menger

Patronage Markets are multi-party games with unique roles. Economic incentives steer participants towards the long-term growth of the markets.

The main participants of a Patronage Market are:

- Creators,

- Patrons, and

- Developers

1. Creators

Creators issue unique personal cryptocurrencies backed by products and/or services which makes it spendable.

Creators use their knowledge and creativity to create Patronage Markets that have wide appeal. To give instrinsic value to their tokens, Creators offer products and/or services in exchange. By purchasing a Creator’s personal currencies, Patrons can buy credit for a Creator’s future work.

Skilled professionals may offer to perform services in exchange for payments in their own Patronage Token. An artist’s token can be redeemed for a painting. A vlogger’s token may be exchanged for votes on her content schedule. A domain expert’s token can be used to purchase an hour of personalized consulting. Creators may also host dApps that perform a unique function in exchange for tokens. Buyers and sellers offer and fulfill bounties in a decentralized marketplace using Patronage Tokens.

As a Creator’s services gain more demand, more of their tokens will be in circulation and so its price increases. If their services are no longer needed, the tokens are burned out of the market and its price drops. A Patronage Market naturally dissolves when it has outlived its use.

In a Patronage Market, Creators can:

- Receive tokens in exchange for professional services.

- Charge a contribution fee from token purchases to raise funds upfront.

- Receive tokens as one-time donations or recurring subscriptions.

- Create and sell provably rare digital collectibles to Patrons.

- Charge a fee for decentralized application (dApp) usage.

Creators seek to build a sustainable income stream from their community of Patrons. Patronage Markets opens up an array of new funding mechanisms, but Creators must choose their market parameters well. Patronage Tokens that have little utility, high fees, and poor governance will fail to attract Patrons in the long run.

2. Patrons

Patrons collect tokens to redeem it for services and/or exclusive privileges, acquire social status, and invest in promising Creators. Patronage Markets attract Patrons by offering attractive services for its token.

In a Patronage Market, Patrons can:

- Acquire services by purchasing and redeeming Patronage Tokens.

- Acquire provably rare digital collectibles that can grant exclusive privileges or access.

- Have a voice in the community through shareholder voting.

- Support their favourite Creators with donations and subscriptions.

- Invest in promising Creators.

Patrons can share in the financial upside of a Creator’s popularity by acquiring Patronage Tokens. Patronage Tokens rewards Patrons who can discover Creators with the most potential the earliest, because curved bonding ensures that token prices are low when supply is low early on. Opportunities for arbitrage gives the token intermediate utility even when the market is small. In addition, Patrons now have an economic incentive to spread the Creator’s work, allowing fans to actively contribute and be rewarded from the Creator’s rise to fame.

3. Developers

A Patronage Market consists of decentralized applications built and deployed onto the blockchain. Decentralized application development is a highly technical undertaking involving blockchain technology and smart contracts.

People lacking the expertise must place a great deal of faith in the developer community, much as non-specialists who want to understand the results of a specialized science do of the corresponding scientists.

Developers build decentralized applications that facilitates exchange between Creators and Patrons. Developers can set a usage fee for their dApps. Earning a stake of Patronage Tokens helps align the Developer’s self-interest with the long-term success of a Patronage Market.

In a Patronage Market, Developers can:

- Build dApps for Creators and Patrons.

- Promote their dApps to Creators and Patrons.

- Acquire tokens from dApp usage fees.

Any Developer can innovate and build new dApps freely for any Patronage Market and for any Patronage Token in a permissionless manner, without needing anybody’s approval. Use cases such as donations, subscriptions, cryptocollectibles, community votes, and more are potential applications. The use cases we that can conceptualize today are by no means exhaustive.

Appendix: Open Design Questions

Shape of Bonding Curve

The exact curve parameters that would lead to a successful patronage token remains an open problem. Should the curve be linear? Exponential? Logarithmic? Sigmoid? Dynamic? Should there be a cap on the number of tokens in circulation? Should there be separate buy and sell curves? Should buy and sell orders be processed in batches?

There are a ton of potential design combinations possible, and it remains to be seen which experiment will bear fruit.

Stablecoins as Collateral

Patronage Tokens may use Ether (ETH) as the Reserve Token for our Patronage Tokens. While this is a natural fit in many ways for a decentralized platform running on Ethereum, ETH is highly volatile. ETH’s spot price can rise and fall due to market fluctuations. Price volatility makes Ether unsuitable as a store of value. Instead of a volatile asset, the reserve token should be in something stable.

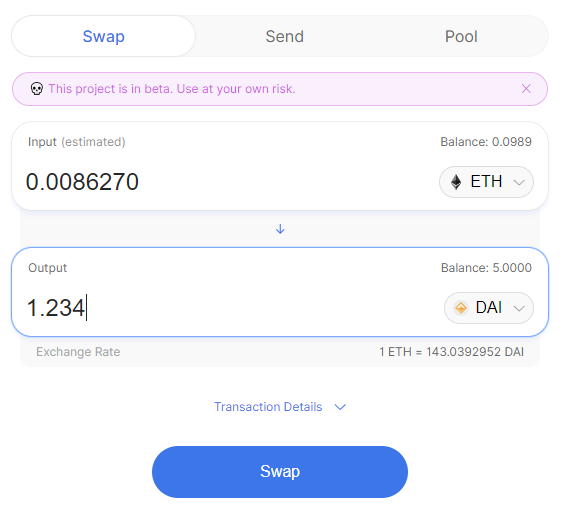

Stablecoins are cryptocurrencies designed to minimize the effects of price volatility. Compared to Ether, they are more suitable as a store of value and unit of account. An example of a stablecoin is DAI. Patronage tokens can use Dai as collateral instead of Ether.

Spendability and Network Effects

The utility of a currency depends on its spendability. Put simply, a token that can be redeemed for many services is more useful than another token spendable for few. Spendability is especially important when on-ramp and off-ramp fiat exchange pathways can be censored by centralized platforms.

Unfortunately, each Patronage Market is a separate ‘walled garden’ economy. A Patronage Token may not be spendable in Patronage Markets other than its native market. To benefit from network effects and for users to access a wider array of services, we need a way for Patronage Tokens to be spendable across different markets.

We can accomplish this through currency conversion between Patronage Tokens. For example, we can utilize protocols such as Uniswap to create liquidity pools for each ETH - ERC20 Patronage Token trading pair. Users will then be able to trade their Patronage Tokens for another at any time and at deterministic prices.

Appendix: Technical Specification

The Patronage Token model is composed of several cryptoeconomic primitives:

-

Continuous Token prices are calculated by the contract along a predefined Bonding Curve. This means prices are set according to a deterministic set of rules.

-

Automated market makers allow users to buy and sell tokens at any time from a smart contract. This means trading begins immediately after market creation, and patrons are free to trade on any market.

-

Patronage Tokens can optionally implement token standards such as ERC20, ERC777, and ERC1400. This allows the Patronage Token interface to be composed into other token models and protocols.

Automated Market Makers

An automated market maker contract is a specific type of contract that issues its own Continuous Token. Prices are calculated by the contract based on a bonding curve.

An automated market maker hold a balance of a Reserve Token (e.g. a balance of ETH.) To buy Continuous Tokens, the buyer sends some amount of ETH to a smart contract. The smart contract uses a bonding curve to calculate the price of the token in a ETH and issues you the correct amount of Continuous Tokens. Selling works in reverse: the contract will calculate the Continuous Token’s current selling price and will send the correct amount of ETH.

In a typical cryptocurrency exchange (either centralized or decentralized) Market Makers create buy or sell orders for a particular token exchange pair, and Market Takers fill any satisfactory orders to perform the exchange.

In this workflow, a matching process is necessary for an exchange to occur. Market makers need to create orders, orders need to be published on exchanges, market takers need to browse orders, and market makers need to wait for the orders to get filled. Because both buy and sell orders have prices attached to them, due to market fluctuations there is the possibility that some orders may take a while to get filled, if ever.

In contrast, automated market makers provide an always available source of liquidity. Users can always buy or sell tokens in the network directly through their smart contracts, even when there are only few or no other buyers or sellers in the market.

Depending on the algorithm used markets can be made to be more or less sensitive to price volatility. Users can interact with a bonding curve by staking tokens into the bonding curve’s reserve pool, when they do the bonding curve mints corresponding tokens for the user based on the the pricing algorithm. The newly minted tokens can have specific utility and even be traded among users, but can always be exchanged back through the bonding curve for tokens in the bonding curve’s reserve pool.

A reserve pool is necessary for the bonding curve to function as an automated market maker. If funds are removed from the reserve pool it impacts the pricing algorithm, and if the reserve is depleted entirely the bonding curve will no longer function at all. Therefore, it is critical that the process of removing funds from the reserve pool is strictly limited.

Patronage Token Interface

Patronage Tokens implements an IContinuousToken interface, which describes an ERC20 curve-bonded token:

contract IContinuousToken is IERC20{

event Bought(address indexed account, uint amount, uint value);

event Sold(address indexed account, uint amount, uint value);

function buy(uint deposit, uint minReward) external payable returns (uint);

function sell(uint amount, uint minRefund) external returns (uint);

function getBuyReward(uint buyRewardAmount) external view returns (uint);

function getSellRefund(uint sellAmount) external view returns (uint);

function reserveRatio() external view returns (uint32);

function reserve() external view returns (uint);

function reserveToken() external view returns (address);

}Since the Patronage Token automated market maker contract is entirely on-chain, prices can change between when a transaction is signed and when it is included in a block. Traders can bound price fluctuations by specifying the minimum amount bought on sell orders, or the maximum amount sold on buy orders. This acts as a limit order that will automatically revert if it is not filled.

Patronage Tokens implements the IPatronageToken interface which adds functionality around contribution rate and beneficiaries:

contract IPatronageToken is IContinuousToken {

function initialize(

uint32 reserveRatio,

uint initialReserve,

uint initialSupply,

uint32 contributionRate,

address[] calldata beneficiaries,

uint[] calldata shares

) external payable;

function contributionRate() external view returns (uint32);

function getContributionFee(uint depositAmount) external view returns (uint);

}Summary

A Patronage Market is a cryptoeconomic system that facilitates market-driven ex-change between Creators and Patrons on the Ethereum blockchain. It’s an alternative crowdfunding mechanism for a community plagued by platform censorship.

Patronage Markets is an idea that is very much in progress. If you have any comments, feedback, or suggestions please comment below or feel free to email me.

Thank You

I’d like to thank the following people whose writings have shaped my thinking in this space: Mike Merill, Jonas Lund, Saray Meyohas, Bancor, Ujo Music, Simon de la Rouviere, Slava Balasanov, Thibauld Favre, Chris Dixon, Kyle Samani, Vitalik Buterin, Friedrich Hayek, Jörg Guido Hülsmann, Murray Rothbard, 1Hive, and many others I may have missed.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.