How The Blockchain is Changing How We View Art

Saturday, 20 April 2019 · 27 min read · ethereum

Cryptocollectibles are rapidly becoming one of the earliest mainstream use cases of the blockchain. Let’s examine how the blockchain is changing how we view art.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.

Collectibles as Proto-Money

The human instinct to collect runs deep in our evolutionary history. In Shelling Out: The Origins of Money, Nick Szabo outlines how collectibles were the early precursors of money. Practically all human cultures, even those that do not engage in substantial trade or that use more modern forms of money, make and enjoy jewelry, and value certain objects more for their artistic or heirloom qualities than for their utility.

People collected shells, furs, teeth, cattle, gold, silver, weapons, and other objects as mediums of exchange. Szabo concludes that money had to have the following properties:

- Secure from accidential loss and theft. For most of history this meant carriable on the person and easy to hide.

- Hard to forge its value. This usually meant that it was time-consuming to create.

- Its value was more accurately approximated by simple observations or measurements. In other words, it’s clearly divisible.

Jewelry, made at first out of the most beautiful and less common shells but eventually in many cultures out of precious metals, comes closer to satisfying all three properties. It is no coincidence that precious metal jewelry usually came in thin forms such as chains and rings, allowing for inexpensive assaying at randomly chosen locations. Coins were a further improvement – substituting small standard weights and trademarks for assays greatly reduced the costs of small transactions using precious metals. Money proper was just a further step in the evolution of collectibles.

- Nick Szabo, “Shelling Out: The Origins of Money”

Property (2) is especially relevant to how we think of art today. Artworks are more prized the rarer they are. From a collector’s perspective, rarity determines value.

Interestingly, Cryptocollectibles satisfies all three properties: (1) through its digital and non-custodial nature, (2) through cryptography, and (3) through tamper-proof public data of past bids, transactions, and ownership.

Scarcity and Value in Art

Scarcity justifies the price of a collectible because it suggests an exclusive club of ownership. Rarity in the art world is determined by several attributes:

- Has the artist been written about in art magazines? Is the artist well-known? Is the artist an emerging talent?

- Is the work of high quality?

- Has the work been exhibited in a gallery?

- Is the work done in the artist’s most characteristic style?

- How many copies of the work exist?

- Will more work of this kind be produced by the artist?

- How easily can the work be forged?

Based on the above criteria, art investors will seek artworks that will go up in value over time. Esssentially this means obtaining items that are rare and will continue to be rare in the long term. If there are no other copies of the work, scarcity is guaranteed.

Scarcity in Digital Art

Then came the digital world.

What does it mean when a digital work of art is ‘scarce’? Given the ease at which a picture can be copied, does it make sense to say that a digital art is ‘rare’? In the digital realm, the proliferation of unauthorized virtual copies makes it close to impossible to prove the ownership and authorship of an artwork.

The blockchain seeks to change that.

For the first time ever, limited editions of digital art are possible with blockchain technology. Digital artists can create limited editions of their works, providing a new way to grow their market. Previously, the bane of digital art has been the fact that it’s easy to copy and pirate.

- Elena Zavelev, CEO of New Art Academy

The blockchain offers us a new model for digital art ownership. With the blockchain, digital artwork can be registered as a ‘token’ on a secure, immutable public ledger. By turning an artwork into a token, artists can preserve scarcity and the chain of provenance for each work. As the data remains inscribed on the blockchain regardless of copying or piracy, these tokens become tamper-proof certificates of ownership.

Enter Crypto Collectibles

Cryptocollectibles are a new class of provably scarce digital assets sometimes referred to as Non-Fungible Tokens (NFTs.) They are unique cryptographic tokens which are not interchangeable, unlike cryptocurrencies (Bitcoin, Ether, ERC20 tokens) which are fungible. NFTs offer collectors a way to attain ownership of a digital asset, paving the way for a new era of digital ownership.

NFTs are provably scarce based on data inscribed onto it on the public blockchain. This information can include its serial number from a limited edition, unique attributes, provenance metadata, and so on. Even as the collectible gets passed through multiple hands, its data remains tamper-proof and intact. Each transaction is publicly viewable on the blockchain, creating an audit trail of the asset’s history.

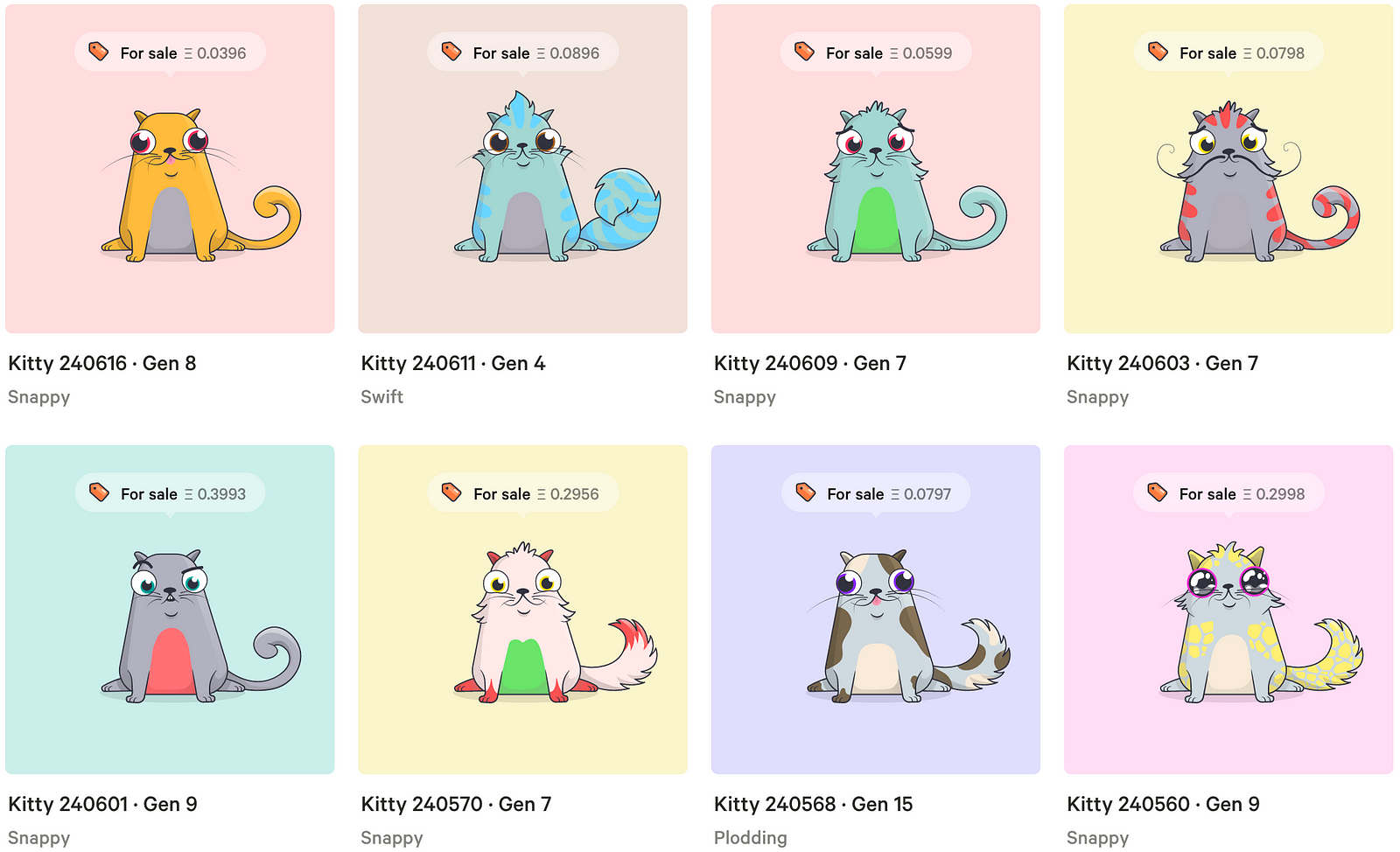

Cryptopunks and CryptoKitties were among the first cryptocollectibles. The latter is a blockchain based game that allows players to purchase, collect, breed and sell various types of virtual cats. Every CryptoKitty’s ownership is tracked via a smart contract on the Ethereum blockchain.

The ERC721 technical standard that emerged from the CryptoKitties team became the ERC20 of collectibles. This standard serves as a set of rules that make an asset (either digital or tangible) become tokenized as a non-fungible token. Each ERC721 token carries unique data and an identifier to track of its provenance and ownership.

Today, there are many more ERC721 tokens ranging from virtual pets to in-game items.

New Marketplaces

Trading is a core part of the collecting experience. You can discover, buy, and sell ERC721 NFTs on an increasing number of digital asset marketplaces. Here are some of my favourites:

- An Axie from Axie Infinity, a blockchain digital pets game where you can battle other players’ axies.

- Virtual land from Decentraland, a virtual reality platform. Users can buy and sell virtual Decentraland land on open marketplaces, and then build custom virtual reality experiences on their land.

- An Autoglyph, the first on-chain generative art on the Ethereum blockchain. The steps to produce the artwork is stored entirely on the blockchain. A completely self-contained mechanism for the creation and ownership of an artwork.

- In-game items from Neon District, an upcoming cyberpunk role-playing game. Players control parties of characters and battle to progress through a sci-fi storyline and earn in-game NFT (non-fungible token) items.

You can see more NFTs available for sale on OpenSea.

Public Transparency and Provenance

Digital art is not the only medium undergoing change. Blockchains can also impact physical art.

An accurate chain of ownership is required to determine the authenticity of an artwork. With the Ethereum blockchain, we get unforgeable attestations that proves authenticity, proof of ownership, and a public history of past transactions. This auditable data can provide transparency and trust for art.

Artory provides a decentralized registry that offers artwork provenance information that proves authenticity. Similarly, Codex Protocol and Verisart issues certificates of authenticity for art and collectibles, recorded on the blockchain.

Hybrid Collectibles

Some collectibles cross between the physical and digital worlds. For example, each CryptoKaiju toy contains a tamper resistant, NFC enabled certificate of authenticity that is linked to their ERC721-compliant smart contract. This lets us track its provenance in a trustless manner.

Fairer Artist Monetization

Cryptocollectibles can be a new way to fund creative work.

For the longest time there were few monetization opportunities for small-time artists and creators. Crowdfunding platforms such as Kickstarter and Patreon opened new doors, until the deplatformings started. In a period rife with economic censorship, tamper-proof funding mechanisms are becoming increasingly important.

NFTs allow artists to create unique, limited-edition digital artwork and sell it directly to their fans. Smart contracts allow you to do this without going through a centralized gatekeeper.

SuperRare and BlockPunk allow creators to create and sell limited edition digital artwork as cryptocollectibles. SuperRare artists receive 100% of the proceeds from their first sale and takes no cut. Blockpunk creators receive 70% while the remaining 30% goes to BlockPunk.

Capturing Value from Secondary Markets

Once an artist achieves a degree of popularity, there will be a secondary market in his or her work. Her most famous works may enter and leave public auction multiple times over the course of the artist’s lifetime. However, 100% of the proceeds from an auction is pocketed by the owner - none to the creator. Creators are unable to capture value in their artworks’ secondary markets.

Instead of paying a creator just once - for the first sale - the blockchain enables commissions on secondary sales. If a cryptocollectible was sold at public auction, smart contracts can split 90% of the sale price to the current owner and the remaining 10% to original creator. Should there be a strong secondary market for an artwork, this royalty system creates a recurring income stream for the artist.

The open source This Artwork Is Always On Sale (TAIAOS) uses a Harberger Tax mechanism to pay the artist, where a continuous tax is levied as patronage towards the artist based on the owner’s set price. Buyers of a Harberger Taxed asset must always specify the new asking price at which they are willing to resell it, ensuring liquidity. Prices reflect how much something is valued in a transparent and democratic way.

Collectibles as Utility Keys

Given the ease at which a digital asset can be copied, most people simply don’t understand the point of acquiring NFTs. Scarcity in a digital realm just doesn’t seem to make sense. How should we present NFTs to gain acceptance by a mainstream audience?

Increasingly, consumers of today wish to buy experiences instead of products. They hope that their belongings give them access to communities instead of just their ownership. NFTs could fill that role.

NFTs can be presented as keys that grant its owners a right-of-use to a good or service.

A promising project in this space is the Unlock protocol. The team is working on a way to allow consumers to gain exclusive access to works such as publishing and software licenses, using keys on the Ethereum blockchain.

Once people overcome that initial mental hurdle, they will gradually appreciate the social and signaling functions of scarce digital collectibles. After all, most physical luxury goods (watches, bags, sneakers) have little utility beyond social signaling.

Democratizing Access through Fractional Ownership

With famous art pieces priced at six-figures and above, there art market is very illiquid. Most people simply cannot afford million-dollar purchases.

As in real estate tokenization, fractional ownership can open the art market to participation from a greater pool of investors. While physical paintings cannot be broken down and handed to multiple owners, we can overcome this limit by tokenizing and representing ownership digitally. The asset can then be broken down into several portions and purchased by multiple owners. Decentralized exchanges on the blockchain improves liquidity by enabling the transfer and trade of these digital certificates. Smaller units of purchase can potentially lead to greater liquidity in secondary markets.

Art startup Maecenas wants to make it possible to buy shares in an artwork. A single ERC 721 token and a fixed number of ERC20 tokens represents ownership of the physical asset.

Summary

Blockchain technology is changing the way we view art in a number of fascinating ways. The technology offers tamper-proof provenance, digital scarcity, fairer monetization, fractional ownership, and greater liquidity for a traditionally rigid and illiquid asset class.

NFTs offer a new form of digital ownership and patronage. With many projects in active development, it’s an exciting time to be a creator.

📬 Get updates straight to your inbox.

Subscribe to my newsletter so you don't miss new content.